GM Cruise Steps Up Commercial Ops, Hastening Revenues From Autonomous Tech

Table Of Content

The cruise line industry is part of the broader travel and tourism industry, focused primarily on providing sea-based vacation experiences. Companies in the industry own and operate cruise ships in various destinations worldwide, offering a variety of itineraries and themed cruises. The big cruise line companies include Carnival Corp. and Norwegian Cruise Line Holdings Ltd. The reality on the ground is that Cruise is getting ready to take off as a company. It has a permit in California to perform fully autonomous rides for select customers and can now charge for rides in a vehicle with a safety driver.

Funding, Valuation & Revenue

Exclusive: GM's Cruise valuation slashed by more than half, adding to woes - Reuters

Exclusive: GM's Cruise valuation slashed by more than half, adding to woes.

Posted: Thu, 29 Feb 2024 08:00:00 GMT [source]

These are the cruise line stocks with the lowest 12-month trailing price-to-sales (P/S) ratio. For companies in early stages of development or industries suffering from major shocks, this can be substituted as a rough measure of a business's value. A business with higher sales could eventually produce more profit when it achieves (or returns to) profitability. The price-to-sales ratio shows how much you're paying for the stock for each dollar of sales generated. The auto maker has acquired Cruise Automation, a San Francisco-based autonomous vehicle technology maker. The companies did not announce financial terms, but Fortune says the deal is valued at more than $1 billion between cash and stock.

Investments

Earlier this year, he named former Delta Air Lines Inc. executive Gil West as chief operating officer. The company also acquired startup Voyage in March in an effort to bring in tech talent. Ammann is expected to show how Cruise can increase revenue to $50 billion or more and provide analysts with details on cost per mile to consumers. The presentation will show how some big-name companies took years to get to that kind of revenue, the people said.

Investors

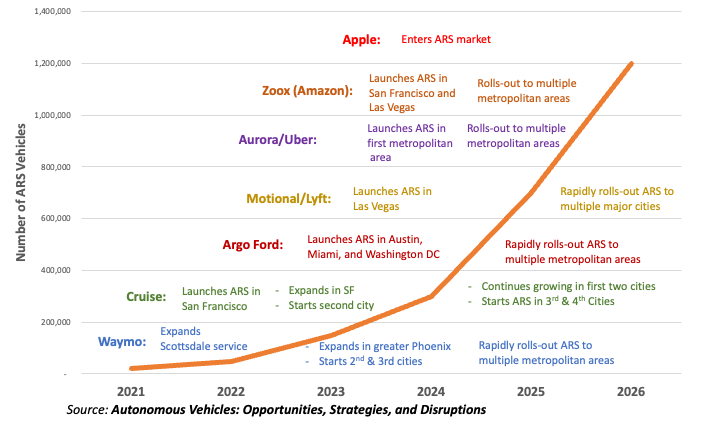

The case for this is based on either autonomous ride services never being feasible or Cruise failing to establish a competitive presence in this market. And it is the classic successful strategy of a technology/capital-intensive business model replacing a labor-intensive business model. Cruise developed multiple iterations of an autonomous first-generation ARS vehicle.

In May 2022, the company announced it would resume sailing all its cruise ships to meet rising demand. With its full fleet back in service, management expects NCLH to generate positive operating cash flow in the second quarter. Most cruise stocks are underperforming the index and are currently trading near their 52-week lows. This might sound paradoxical, as cruise companies are delivering solid growth in revenues.

GM Cruise safety issues has investors, Wall Street watching closely - Detroit Free Press

GM Cruise safety issues has investors, Wall Street watching closely.

Posted: Fri, 10 Nov 2023 08:00:00 GMT [source]

Cruise IPO: How to buy this autonomous car maker's stock? - Kalkine Media

"The Origin is a real vehicle now, and we're currently testing it on closed courses," he said. Even with $1 billion in revenue still on the plate, profits likely are not. All in all, the potential for Cruise is quite massive, but it requires a near-perfect execution as the decade progresses to reach such potential. Aside from geographic expansion, Cruise is also exploring an expansion of driverless delivery services, like what it is testing with Walmart in Phoenix. Driverless services are an entirely different use case and may also be easier to scale due to the lack of passenger liability.

Cruise, in which GM has a majority stake, hopes to start charging for rides next year with a modified version of the Chevrolet Bolt electric car. Ammann is expected to say that if California Public Utility Commission approvals are obtained, the company could start offering shared ride services in 2023 with its Origin autonomous shuttle. It will be built alongside the Hummer EV and electric Chevrolet Silverado pickup in GM’s Detroit-Hamtramck plant.

Service Area Expansion In San Francisco

Corporate bonuses were also moved up two months, from March to January. Some sources suggest senior leadership adjusted the corporate bonus schedule to assuage workers who have described low morale throughout its ranks. Cruise's current fares "include a base fee of $5 and a $0.90 per mile and $0.40 per-minute rate." Fares also include a 1.5% city tax, and are calculated "using the estimated time and distance of the fastest, most optimal route."

GM Is Doubling Down on Cruise's Autonomous Future

An expansion to match nighttime service are will greatly expand reach, although Cruise still will not have access to the high volume, taxi-dominated northeast corner in District 3 and 6. Autonomous driving is improving rapidly, but the leaders may not be who you think. Cruise, the company majority owned by General Motors (GM -0.17%), is now operating commercial vehicles in three cities and is rapidly expanding its service area. If it grows quickly, this could be a more valuable company than GM is today, which Travis Hoium highlights in this video. Alphabet Inc.’s Waymo self-driving vehicle unit is collecting fares in the Phoenix area and has a permit to operate autonomous vehicles with a safety driver in parts of San Francisco and San Mateo counties, the California DMV said last week.

Both current and former workers were informed in a company-wide email sent around 9 a.m. The importance of these outside investments, in addition to raising the necessary capital, is that it is now almost a certainty that Cruise will be spun out from GM. These big outside investors are expecting to get a return on their investments, and Cruise is now managed by an independent board.

Based on the Chevrolet Bolt EV, it is a dedicated self-driving, pure electric sedan, and some versions have no steering wheel or pedals. This is the primary vehicle used to develop and test its autonomous driving in San Francisco. Most likely, Cruise was previously planning to launch Cruise Anywhere with this fleet of first-generation vehicles but changed its plans once launch delays enabled it to develop a second-generation autonomous vehicle. On a positive note, a strong job market, higher household savings, and pent-up demand for travel from the Covid-19 pandemic shutdowns should keep the industry sailing. As most of the cruise company’s stock prices are already battered down, investing in these stocks has become attractive.

Microsoft invested in Cruise's Corporate Minority - VII funding round. Previously discussed estimates were more than $150 billion by 2025 or 2026, in excess of $500 billion in the U.S., and more than $1 trillion globally in 2030. Let's assume that Cruise has 20% of this market, which is a conservative assumption since it is expected to be second to the market, has a good strategy, and is well-positioned. The Origin will operate mostly in the city and on trips to the airport, so the design is useful to passengers rather than a sleeker design typically preferred by owners. With rising environmental awareness and a need to preserve the environment, demand for such expeditions should grow. PCMag supports Group Black and its mission to increase greater diversity in media voices and media ownerships.

However, it is now experiencing a steady increase in revenues and future bookings. At the end of Q1 2022, revenues surpassed consensus estimates by $10.7 million to register $67.8 million, led by an increase in expeditions and trips. Management noted total bookings for future cruises have doubled in Q versus Q1 2022, marking the best volume since the beginning of the pandemic. As such, CCL is bringing more ships into service in order to cater to the higher demand.

Comments

Post a Comment